[boxleft] This article first appeared on SACSIS

[/boxleft]

The “toilet wars” have made apparent the ridiculousness of the major political parties in South Africa. The Democratic Alliance (DA) even allowed a legal process to work its way up to the Constitutional Court to defend its decision to build unenclosed toilets. On the other hand, the African National Congress (ANC) was quick to wail “mea culpa” when it was found that one of its municipalities had also built unenclosed toilets. The difference in how both parties responded to the public outcry is important and hides a deeper truth.

Some politician sitting somewhere in an office, who probably never visited the site, facilitated the decision making process. In his or her insulated discussion, they would have justified the decision to build open toilets by arguing that more toilets could be built within the budget, or that an open flush toilet is more sustainable than a pit latrine in the long-term.

The alternative explanation is that local councils, even large metropolitan councils, lack the ability to carefully evaluate project plans and approve projects with an accurate understanding of the details of each project. It leads to a situation where municipal governments are genuinely surprised to find out that projects are completed “to spec” and that the specification does not specify the building of walls around a toilet. Sadly, any student of “development” will recognise this as another tale of significant silliness by bureaucrats and politicians. It leaves us all with that incredulous feeling asking “What where they thinking?” or responding with acronyms such as “WTF!”

Is Cape Town or Johannesburg the best metropolitan government in South Africa?

Political parties have been arguing that the city they govern is the best run in South Africa. A cold hard look at available data shows that there is not much difference between Johannesburg and Cape Town, who occupy the first or second spot in most indices. There is thus no definitive answer to the question, as to which metropolitan municipal government is the best, however voters should be circumspect in assessing the claims of political parties. The argument that Cape Town is exceptional however does not have a solid backing from the data reviewed.

Western Cape local councils perform most productively — ANC 6, DA 4

Reviewing data on Top Ten most productive local councils in South Africa. Shows that simple descriptions of performance by political parties spins the data. Voters need to be reflective in evaluating the messages from political parties.

Online retail study shows signs of growth in South Africa in 2010

Online retail study in South Africa shows strong growth between 2009 and 2010. This trend is reinforced when a longer perspective is taken.

Immigration policy in South Africa requires coalition building

South Africa must create a coalition between government, business and labour to address immigration policy.

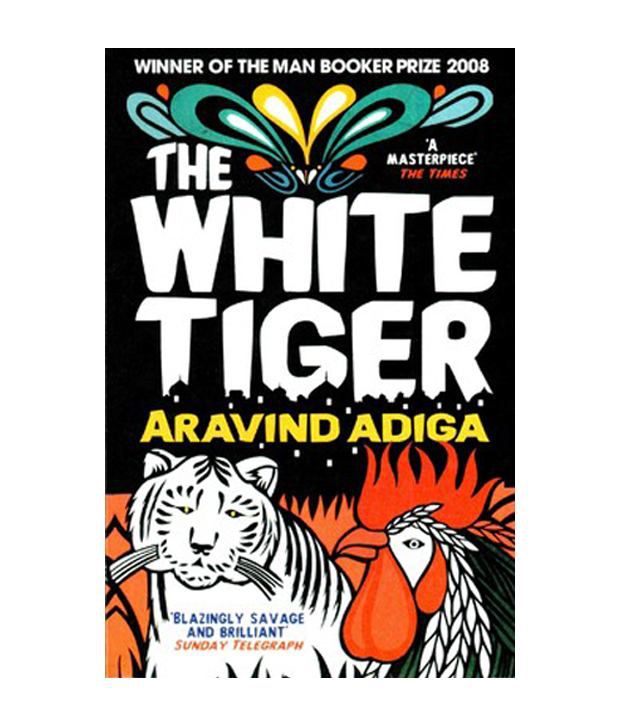

The White Tiger and the Rooster Coop

Aravind Adiga in The White Tiger raises important questions and completes an important feat – rendering the complex concepts of poverty traps and the rah-rah around entrepreneurship accessible in a devastating tale.

The White Tiger by Aravind Adiga, Atlantic Books, Published March 2009, 336 pages, ISBN: 978 1 84354 722 8

The entrepreneurial story is often about young men – women rarely feature as protagonists – undertaking the journey from rags to riches. Through hard work, attending the University of Hard Knocks the protagonists find a route to social mobility and respect. This universal storyline has been criticised so consistently that to equate entrepreneurial success with hard work, dedication and perseverance – without referencing to contextual factors – is to be guilty of the Haratio Alger Myth. The author Haratio Alger, was an extremely popular American author writing in the 19th century, who told stories of industrious young men overcoming their poverty, with hard work, initiative and perseverance, and through that becoming not only wealthy, but virtuous people. There is an importance in not reproducing this myth, for as much as we admire the successful and ethical entrepreneur, it provides little understanding of the reasons for her success.

Can the opposite however be true? In criticising those perpetuating the Haratio Alger Myth we may overemphasis the contextual factors that have led to entrepreneurial success. Yet, there is a deeper conclusion that we may reach – entrepreneurial success may transform the lives of the person, but it is not powerful and disruptive enough to change the underlying economic system, meaning that the majority of people stay trapped in conditions of exclusion and exploitation. A demanding question that South Africa must face, and the reason The White Tiger – set in India – has relevance to us in South Africa.

National Planning Commission Goes Facebook, excludes most South Africans

South Africans given first opportunity to input on the development of the National Plan, but only for internet users.

On Zapreneur, I have argued that the national planning process must be made more open for the National Planning Commission to meet its goals. While it is presumptuous to indicate that the article had an influence, The Presidency announced that it will be having NPC Jam Session running for five days starting on the 28 March 2011.

Three things the National Planning Commission should be doing

Proposes a way to make the National Planning Commission work more open and transparent.

Employment in the South African Public Service

Presentation focussed on creating jobs and improving service delivery in the South African public service. Downloadable research report on which the presentation is based.

Safety for Women – The allocations are there, what about implementation?

In his Budget speech, Minister of Finance Pravin Gordhan made specific reference to creating safer communities. While we welcome the increases to the budget allocation, we await to see how the department of Police and Justice and Constitutional Development will spend it.

With the technological revolution, we are fast becoming “online communities” and we are also seeing more crimes perpetrated using advanced technology. As online spaces are also becoming unsafe (a reflection of what is happening in our society), especially for young girls and women, we need our police and justice system to respond to the challenges. Perpetrators of gender based violence are increasingly using technology to lure, track, monitor and stalk women and girls.